Healthier Apps. Better Performance. Delighted

Users.

Happy customers are loyal customers. Our developer-first observability platform delivers the insights you need to improve application performance while balancing roadmap agility and application stability.

Healthier Apps. Better Performance. Delighted Users.

Provide your users the experience they expect. Our full‑stack

monitoring solution delivers real‑time data to improve app performance and help you balance roadmap

agility with application stability.

Build Better Apps with Developer-First Observability

Over 6,000 of the world's best engineering teams use the BugSnag platform to monitor app performance and build better software

Built to handle today's enterprise-scale

Trusted by the world's best engineering teams

Lyft utilizes BugSnag’s two-way sync integrations to ship new product features 40% faster

"BugSnag helps Lyft focus on new features and provide a better experience for our users."

Billy Pham

Technical Program Manager

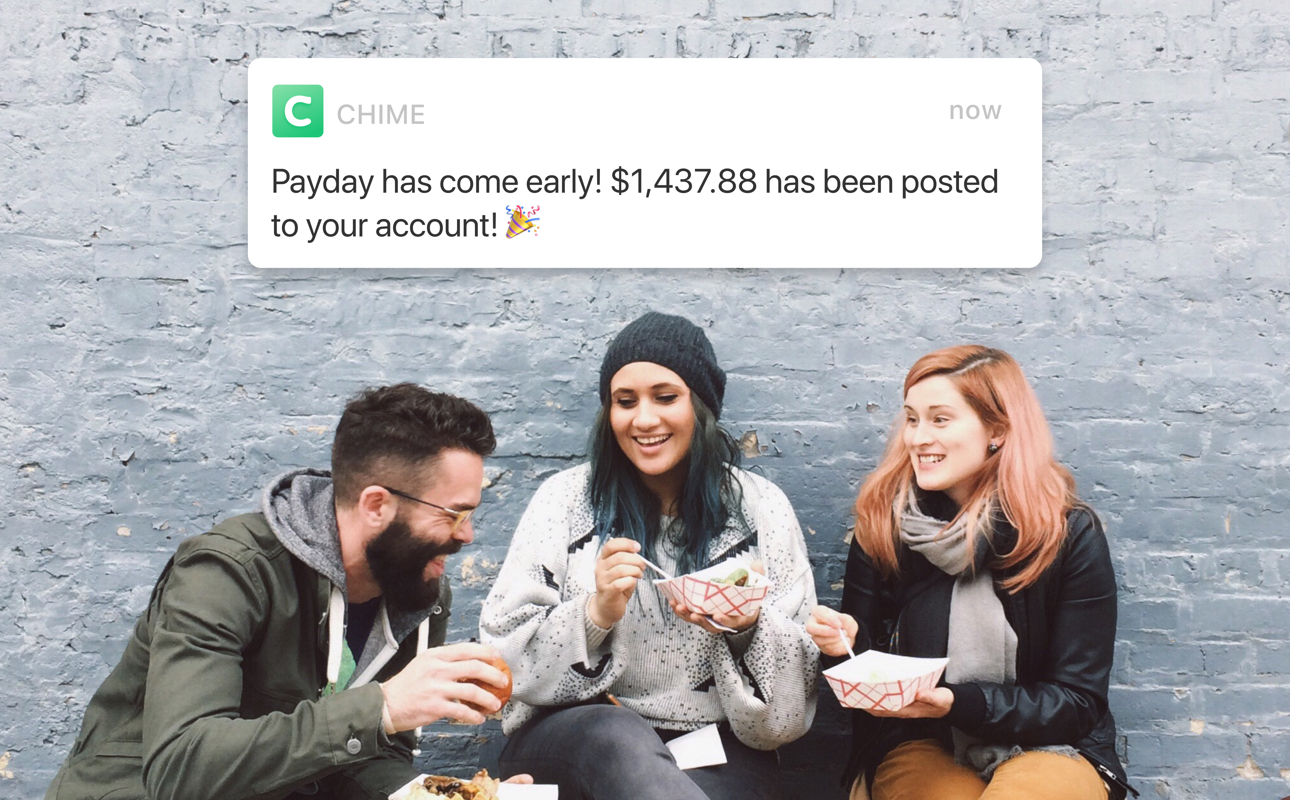

Chime reduces crash rate by monitoring with BugSnag

“BugSnag is a great tool for delivering a better customer experience, making the app more stable, and taking pride in your application as an engineer.”

Software Engineer, Chime

Mercado Libre grows mobile market share by 50% while achieving a 99.93% stability score with BugSnag

"We use BugSnag because we know how to use it, and we trust it, which is most important. We can trust that what we see is what is happening.”

Nahuel Barrios

Engineering Manager

Yelp achieves a 99.98% stability target using BugSnag to improve mobile app stability

"Over the years, we've communicated a lot with the BugSnag team, and a lot of our feedback has been addressed.”

Antonio Niñirola

Engineering Manager